Jordan Tarver has expended 7 many years covering mortgage loan, particular loan and business enterprise loan content material for primary monetary publications which include Forbes Advisor. He blends expertise from his bachelor's degree in small business finance, his working experience to be a best perf...

This deficiency of transparency may perhaps cause misunderstandings or misinterpretations, possibly triggering borrowers to help make decisions that aren't in their greatest curiosity.

To compute precomputed curiosity, lenders establish the whole volume of desire which will accrue around the loan phrase and add it into the principal. The resulting sum is then divided by the volume of months while in the loan term to find out the regular payment.

4. Prepayment Penalties: Some loans may consist of prepayment penalties, that happen to be expenses charged if you end up picking to repay the loan early. Whilst it may feel counterintuitive to penalize borrowers for being proactive, lenders impose these penalties to recoup opportunity missing curiosity.

Late Or Non-Payment Implications By accepting the stipulations for a private loan, you in essence comply with repay the loan both equally: one) with fascination and 2) in the time frame specified in the loan settlement. In most cases, failure to repay the loan in full, or making a late payment, can lead to further fees.

Normally you'd probably established the "Payment Process" to "Arrears" for any loan. Therefore the monies are lent on at some point and the 1st payment isn't because of until eventually 1 time period following the cash are obtained.

one. Limited overall flexibility: Although the entrance-loaded interest allocation in the Rule of seventy eight can benefit borrowers who decide to pay off the loan early, it could be a disadvantage for people who plan to make steady monthly payments through the entire loan term.

one. Front-loaded interest allocation: The Rule of seventy eight makes it possible for lenders to allocate a greater part of the desire inside the early phases of your loan repayment. This can be advantageous for borrowers who decide to pay back the loan early or refinance, as this means they'll have paid out a significant portion with the desire upfront. As a result, this may result in reduce Total fascination expenditures over the life of the loan.

To create our score technique, we analyzed Every personalized loan enterprise’s disclosures, licensing files, marketing and advertising elements, sample loan agreements and Internet websites to understand their loan choices and phrases. 41 Loan Characteristics Tracked

Each and more info every month is then assigned a pounds based on its placement during the loan term. The primary month receives a body weight equivalent to the loan term, the second month gets a pounds a single below the loan expression, etc. This pounds establishes the proportion of fascination allocated to each month.

By being familiar with the mechanics and implications in the Rule of seventy eight, borrowers might make knowledgeable choices and establish ideal approaches to control their loan repayments effectively.

With regards to borrowing funds, amongst The main components to take into account is definitely the repayment conditions. loan repayment terms outline the specific situations underneath which it's essential to repay the borrowed funds, including the interest charge, payment frequency, and length on the loan.

Full our on the net form using your simple data, and we’ll locate a lender that is ready to meet your pursuits. Your own facts is Risk-free with us.

The Rule of seventy eight, generally known as the Sum with the Digits strategy, is really a components that allocates additional desire towards the early repayment duration of a loan.

Scott Baio Then & Now!

Scott Baio Then & Now! Spencer Elden Then & Now!

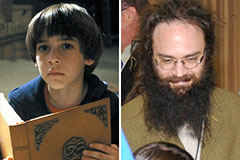

Spencer Elden Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now!